15 an hour salary after taxes

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 15 hourly wage is about 30000 per year or 2500 a month.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Also known as Net Income.

. 1500 an hour is how much per year. This would be your net annual salary after taxes. To turn that back into an hourly wage the assumption is working.

Enter your info to see your take home pay. Annual Income after Tax will be 26520 Annual income Minus 15 of Annual income So the wage of 15 per hour annual salary after taxes. With the average single American contributing 298 of their earnings to income taxes Medicare and Social Security your average take home salary.

SmartAssets Tennessee paycheck calculator shows your hourly and salary income after federal state and local taxes. Your pre-tax salary was 31200. A full-time job earning 15 dollars an hour is 31200 a year.

A full-time workweek consists of 40 hours of paid work hours on average multiple that by the average number of. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Depending on the state you live in.

Publish a Custom Salary Calculator. If you make 55000 a year living in the region of California USA you will be taxed 11676. What is 15 an hour annually after taxes.

If you make 15 an hour you would take home 23400 a year after taxes. What is the minimum wage in Ontario 2022. Net Pay - 1274.

15hour 600week 50 weeks 15hour 57692week 52 weeks Salary Chart. Your employer will withhold money from each of. That means your annual compensation would be between 24700 and.

Your average tax rate is. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

Salary After Tax the money you take home after all taxes and contributions have been deducted. That means that your annual salary would be 24700. However the net pay would reduce that annual pay.

Detailed salary after tax calculation including California State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. However after taxes 15 per hour would be reduced to around 1188 to 1284 depending on the state you live in.

See where that hard-earned money goes - Federal Income Tax Social Security and. That means that your net pay will be 43324 per year or 3610 per month. After taxes though 15 per hour would be roughly 1188 to 1284.

State Taxes of 4. A 15-an-hour yearly salary for a full-time worker would be. Your annual income before tax 31200.

But after paying 25 in taxes your after-tax salary would be 23400 a year. Your employer withholds a 62 Social Security tax and a. If you work 40 hours per week and 50.

15 an Hour per Year after Taxes. Average Tax Rate 151.

10 Free Payroll Check Templates Ms Word Excel Pdf Samples Payroll Checks Payroll Template Payroll

What S Hidden Under The 15 Minimum Wage Higher Taxes Rutgers Business School

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Annual Income Calculator

When Are Taxes Due In 2022 Forbes Advisor

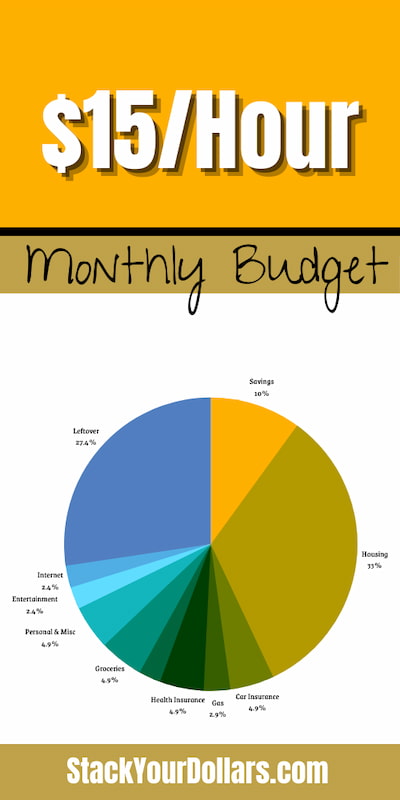

15 An Hour Is How Much A Year Stack Your Dollars

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Gross Pay And Net Pay What S The Difference Paycheckcity

Let S Do The Math What S The Result For Hiring A Va Instead Of A Full Time Employee Answer Va Great Aving Virtual Assistant Paid Time Off Assistant

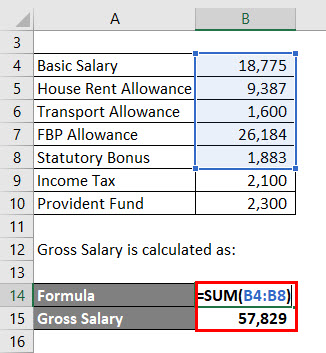

Salary Formula Calculate Salary Calculator Excel Template

After Tax Salary Comparably

15 An Hour Is How Much A Year Stack Your Dollars

Hourly To Salary Calculator Convert Your Wages Indeed Com